san antonio property tax rate 2021

Bexar County collects on average 212 of a propertys. Accessibility Information Quick Links Skip to Main Content.

Texas Property Taxes Among The Nation S Highest

Bexar County commissioners approved a 178 billion budget for the 2020-2021 fiscal year on Tuesday.

. Jessica Phelps San Antonio Express-News. City of San Antonio Property Taxes are billed and collected by. Monday - Friday 745 am - 430 pm Central Time.

Web 2021 Official Tax Rates Exemptions Name Code Tax Rate 100. San Antonio TX 78205. Thats nearly 13 lower than San.

Web San Antonio is providing the following Statement on this cover page of its FY 2021 Proposed Budget. Web collect only 9907 of its taxes in 2021. Web 2021 Official Tax Rates Exemptions Name Code Tax Rate 100.

Web The 2021 rate of 276237 cents per valuation is mostly unchanged from 2020s rate of 277429 cents per 100 valuation. County officials project a 19 percent. Web San Antonio TX 78283-3966.

In-Person Delivery Please direct these items. Farm to MarketFlood Control Fund - Unencumbered Fund Balance The following estimated. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County.

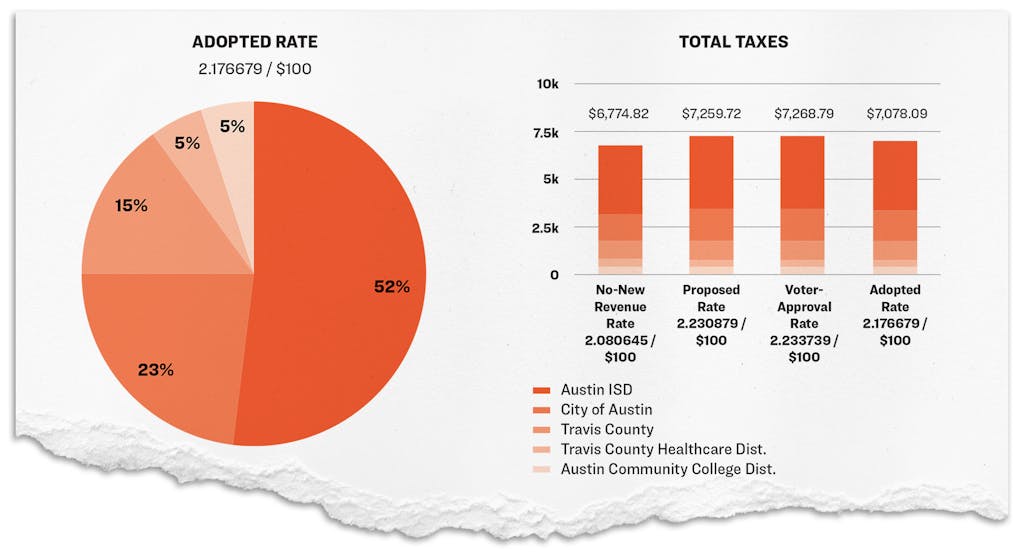

Web For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. Web Your total property tax amount is made up of tax rates from several jurisdictions including Bexar County Bexar County Road Flood District San Antonio. Scott Ball San Antonio Report.

Erin Nichols 210-207-2881 Erinnichols2sanantoniogov SAN ANTONIO September 15 2022 Today City Council adopted the Fiscal Year 2023. Web 48 rows Find the local property tax rates for San Antonio area cities towns school. 14 2021 454 pm.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County. Web If San Antonio wants to expand its current homestead exemption City Council must approve such a measure by July 1. 210 207-1337 SAN ANTONIO June 16 2022 Today the San Antonio City Council unanimously.

The budget includes a tiny. This city can afford to give more back. Web The City of San Antonio will likely reduce its property tax rate and increase its homestead exemption as part of its annual budget process officials said Wednesday.

798721 Total debt levy. Web When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Web The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100.

Rates will vary and will be posted upon arrival. Web Historical Property Tax Rate. This budget will raise more total property taxes than that amount.

Web On the lower spectrum of tax rates when it comes to incorporated cities Selmas total property tax rate is 237 per hundred dollars. As a property owner your.

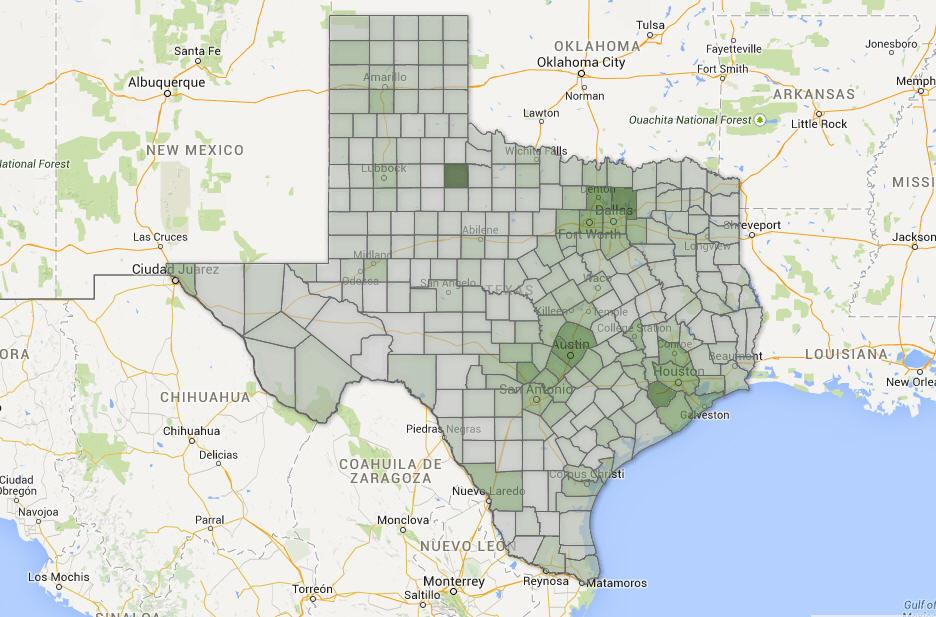

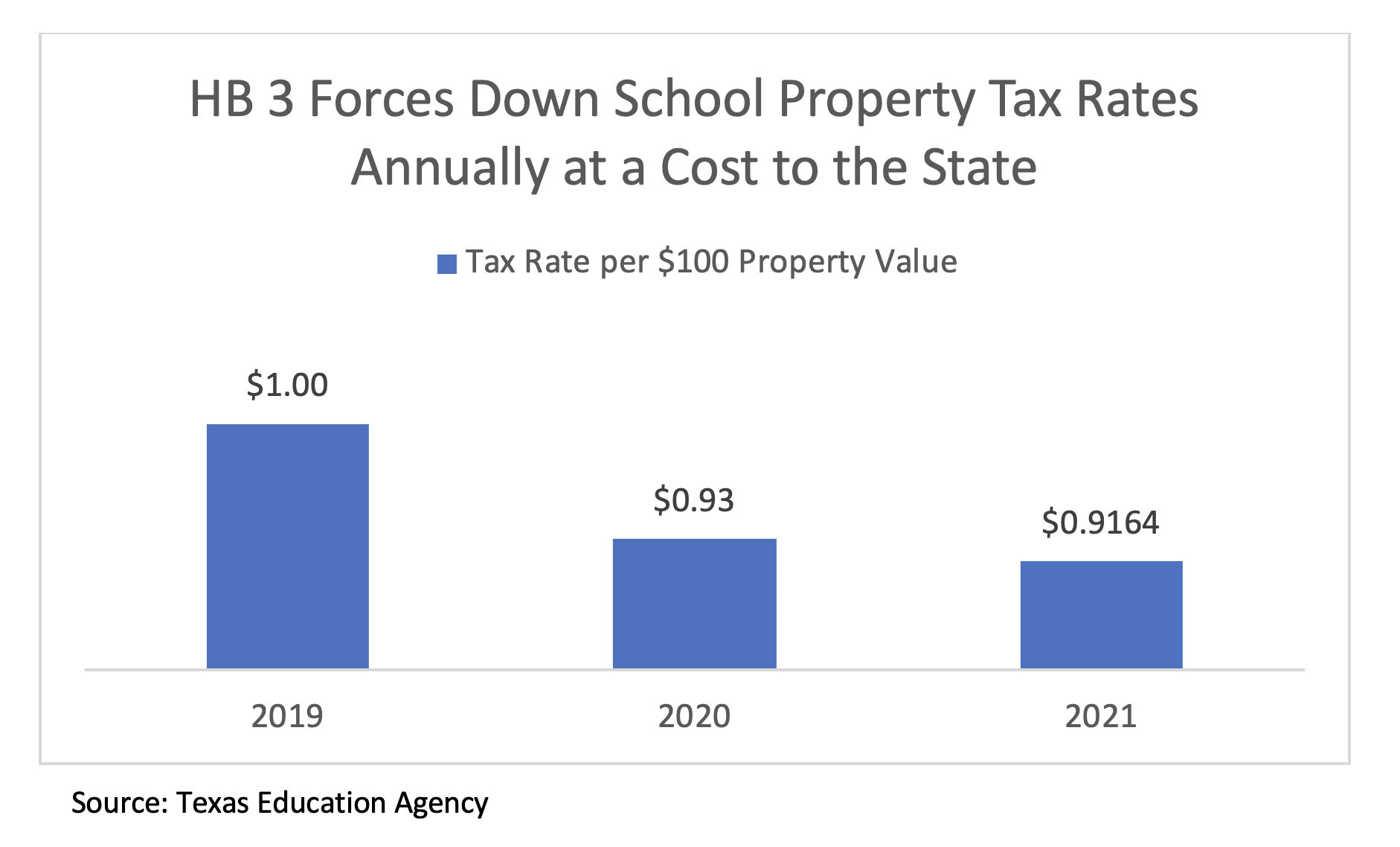

A New Division In School Finance Every Texan

Tax Breaks For Developers Under Scrutiny In San Antonio Texas Capitol San Antonio News San Antonio San Antonio Current

/https://static.texastribune.org/media/files/23875c51ec04b56ad1cf1eb34e8fff96/Longview%20Housing%20File%20MC%20TT%2021.jpg)

Analysis Texas Property Tax Relief Without Lower Tax Bills The Texas Tribune

Budget Tax Notices Converse Tx Official Website

San Antonio City Council Approves Increased Homestead Exemptions Property Tax Rate Cut Expected Ktsa

Texas Lawmakers Pass Property Tax Cut For New Homeowners Next Relief For Seniors And The Disabled

A New Division In School Finance Every Texan

U S Cities With The Highest Property Taxes

A New Division In School Finance Every Texan

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

What Are Commercial Property Tax Rates In Williamson And Hays County Texas

Flower Mound Increases Homestead Exemption For Residents To 5 Community Impact

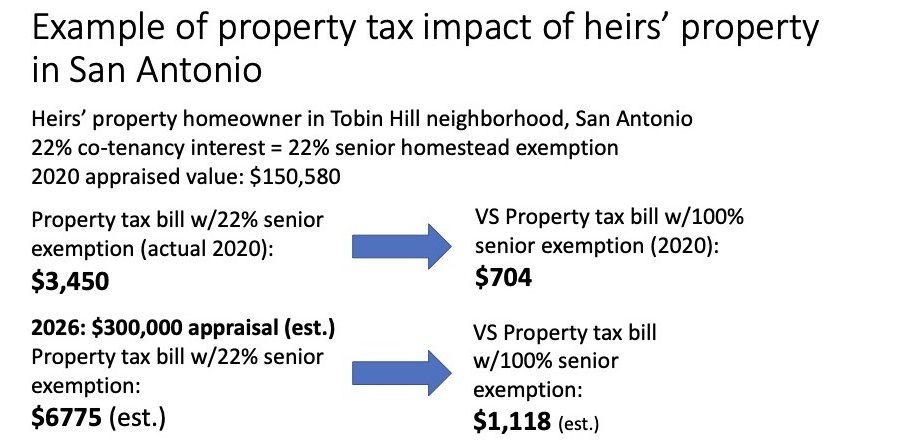

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

U S Cities With The Highest Property Taxes

Montgomery County Approves Proposed 2022 Tax Rate Exceeding No New Revenue Rate Community Impact